By A Mystery Man Writer

What is Negative Correlation? Negative correlation is a relationship between two variables where the variables have an inverse relationship. Basically, with negative correlation, as one variable increases, the other variable decreases. Negative correlation is often described by a correlation coefficient that is between 0 and -1. Two variables with a perfectly negative correlation would have View Article

Domestic and Foreign Mutual Funds in Mexico in: IMF Working Papers

424B1

Treasury Inflation-Protected Securities

Monthly Credit Outlook: February 2023 Monthly Credit Outlook

Full article: Optimal investment problem for an open-end fund with

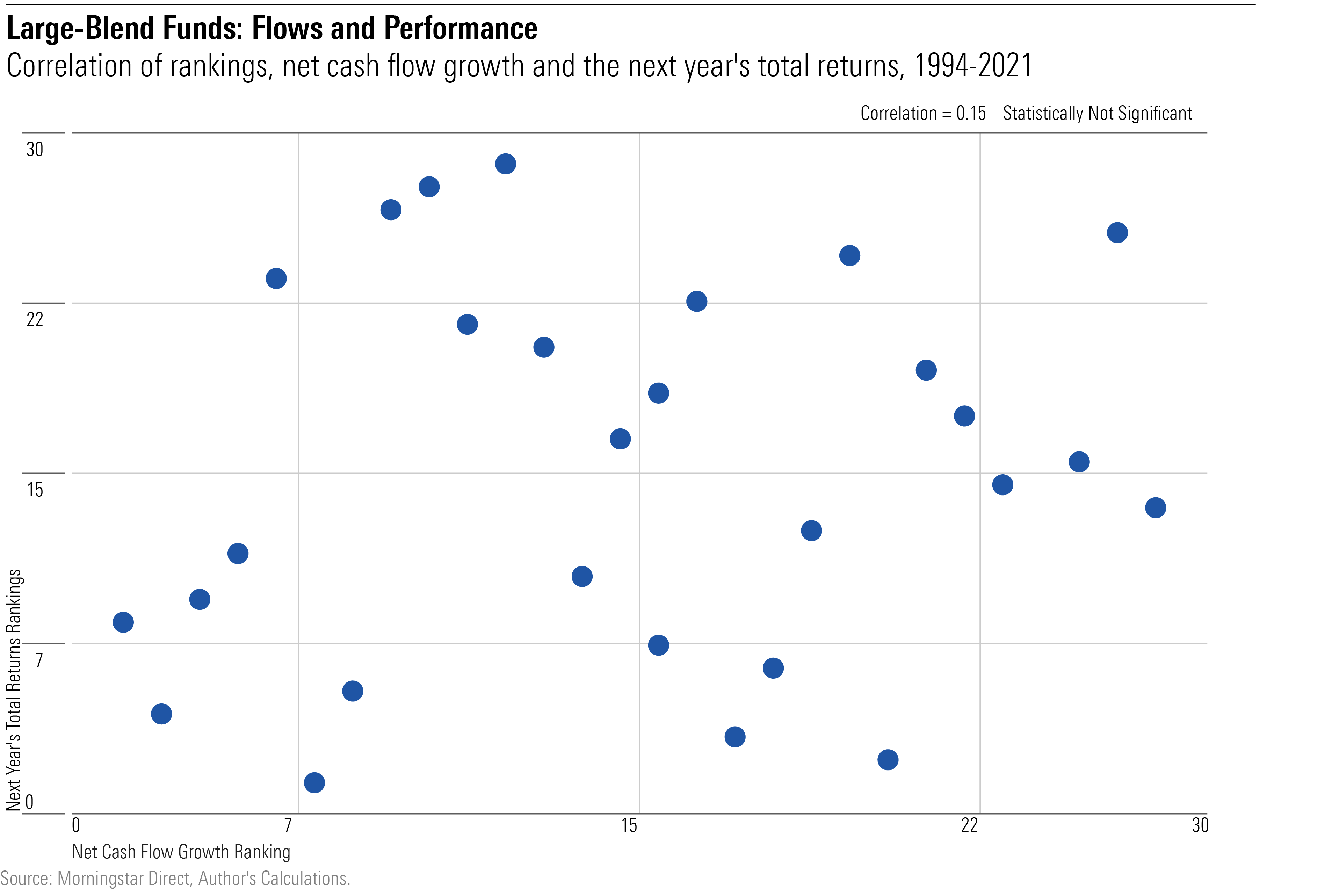

What Bond-Fund Investors Get Wrong

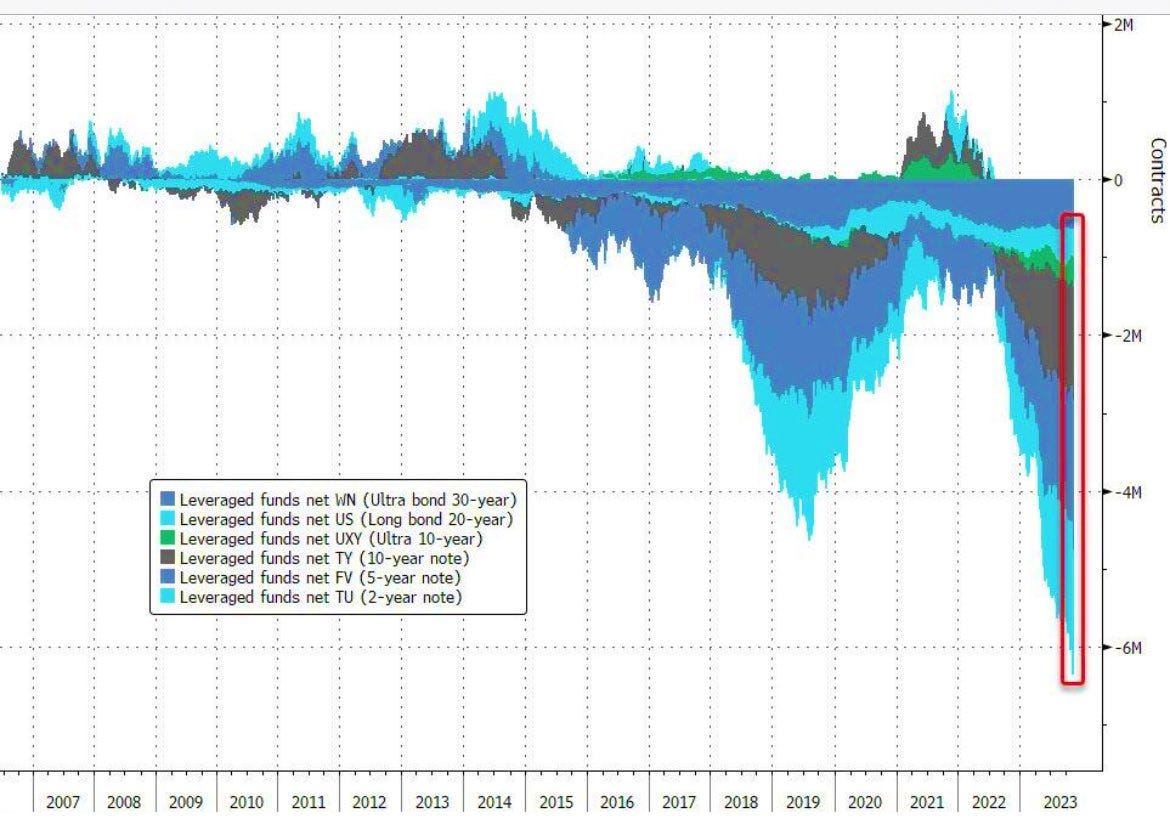

This Isn't Bearish - by Caleb Franzen - Cubic Analytics

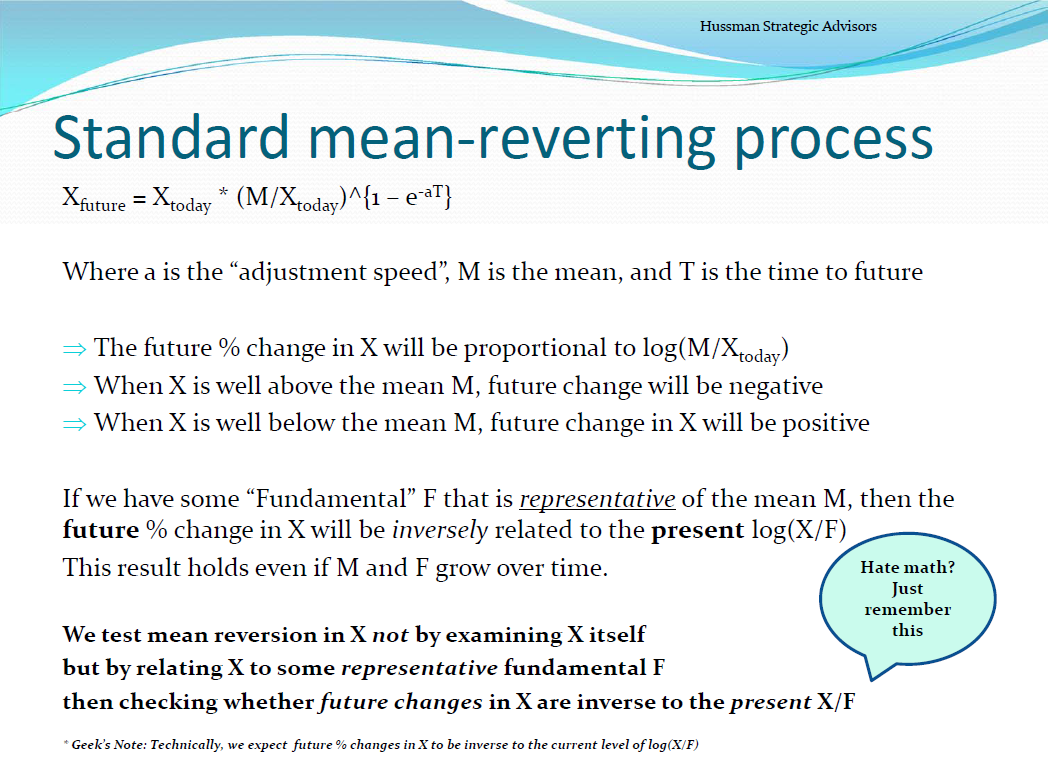

Hussman Funds - Weekly Market Comment: Two Point Three Sigmas Above the Norm - May 4, 2015

Why Hedge? Benefits of CTA and Managed Futures Hedge Funds

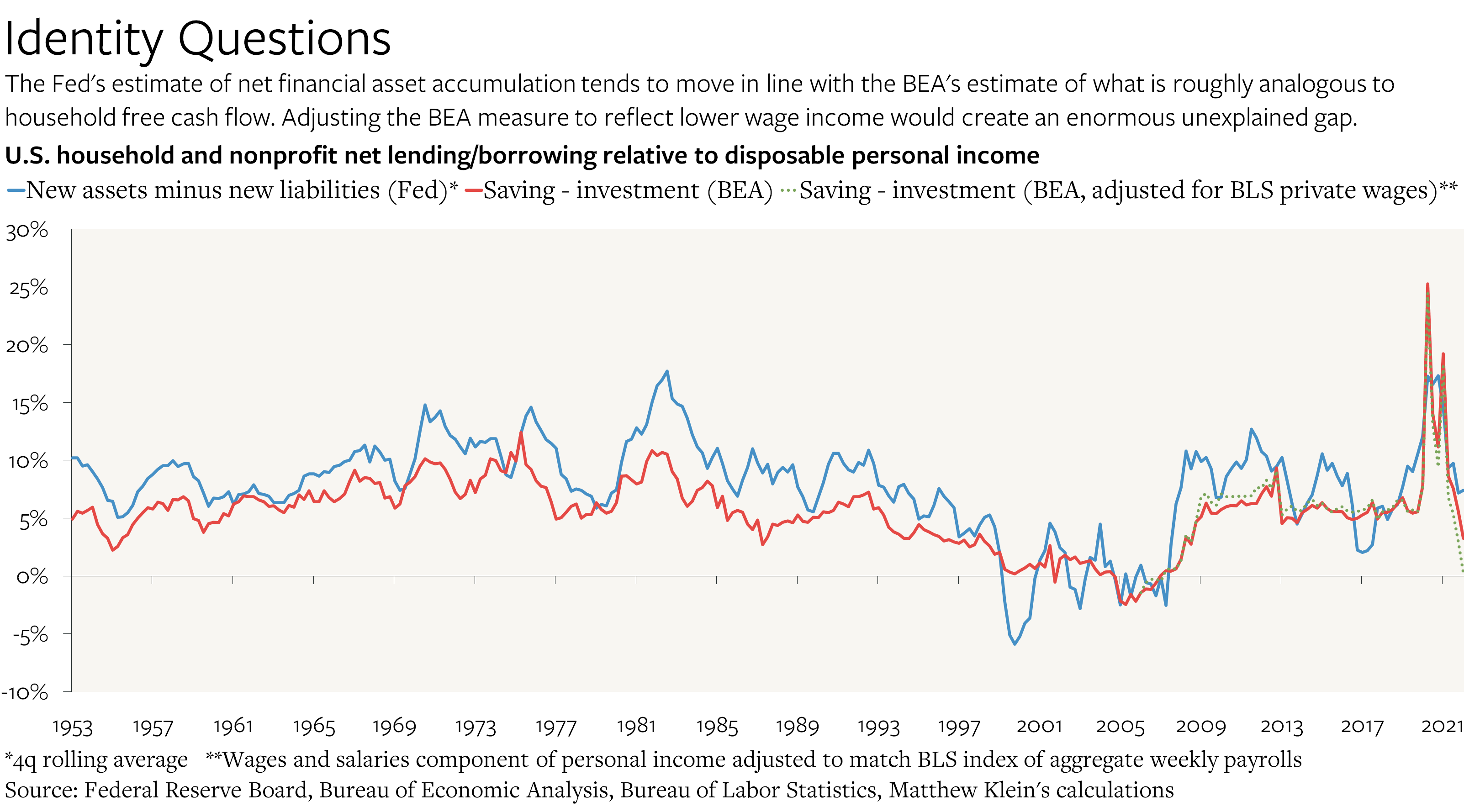

Solving One Puzzle in U.S. GDP Data (Maybe), Finding More

Do mutual fund flows affect the French corporate bond market? - ScienceDirect

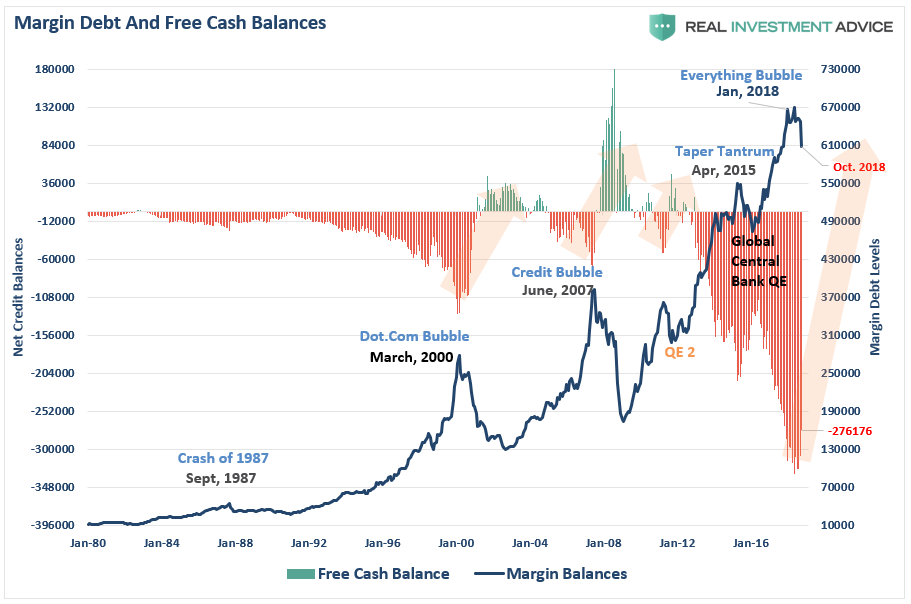

Misdiagnosing The Risk Of Margin Debt

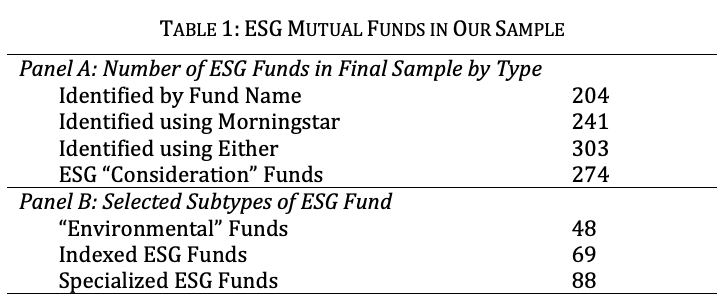

Do ESG Funds Deliver on Their Promises? - Michigan Law Review

Do mutual fund flows affect the French corporate bond market

a2022q2-ex992earningspre