By A Mystery Man Writer

Nigeria - Individual - Residence

Practical Aspects of International Taxation through Case Study

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

Guide to the US France Tax Treaty

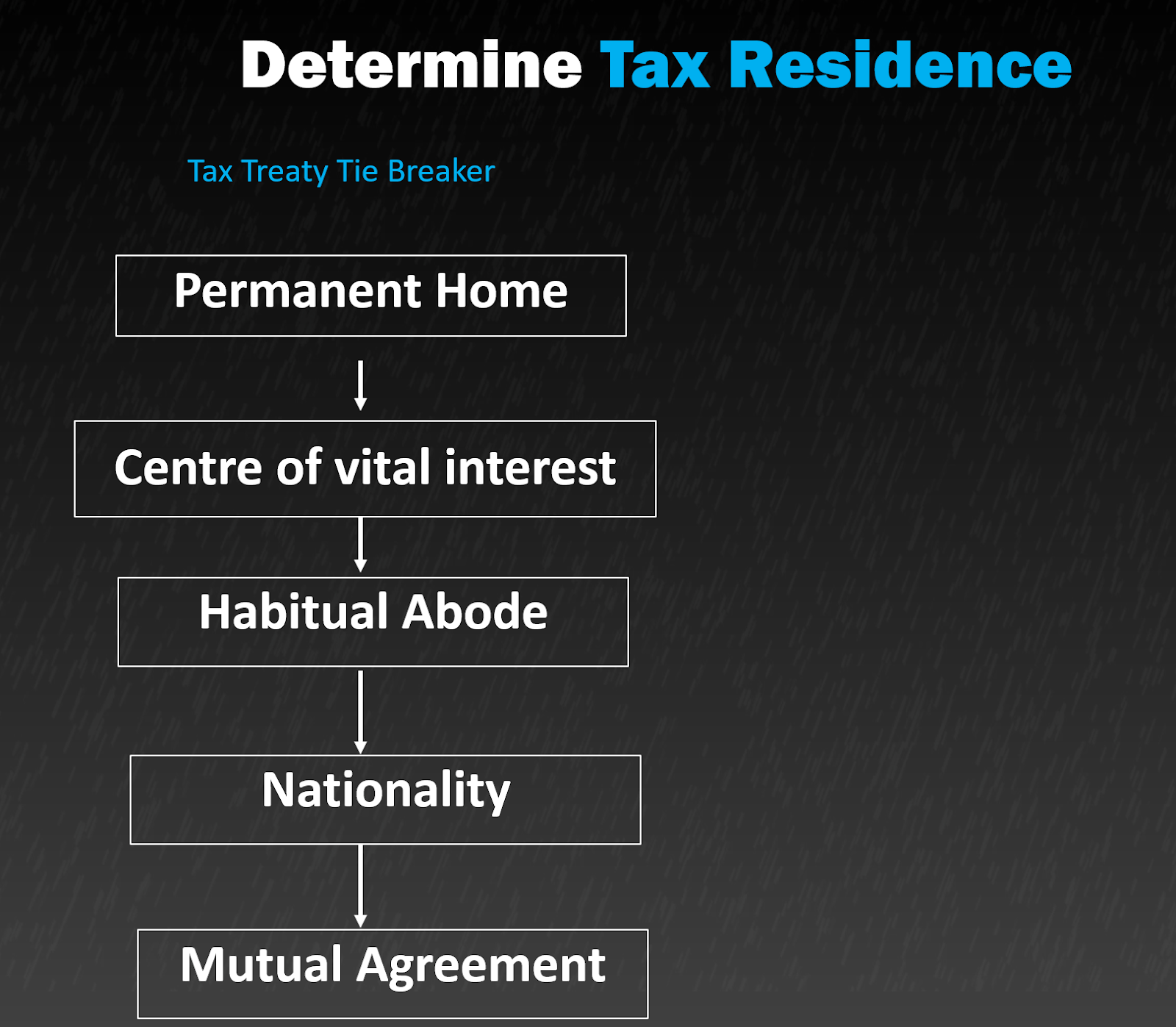

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

Nigeria - Individual - Residence

Tax Treaty: Understanding Double Taxation and Expatriation - FasterCapital

Brazil Taxes for Foreign Citizens - The Ultimate Guide - Oliveira Lawyers

Tax residency: Determining Tax Residency: Key Considerations for Expats - FasterCapital

The Evolving Global Mobility Landscape Tax Considerations

Canada - U.S. Tie breaker rule - HTK Academy

Guide to the US Sweden Tax Treaty