By A Mystery Man Writer

Introduction: In recent times, non-UK resident companies selling on have encountered a new challenge in the form of VAT requirements. is now asking these businesses to pay 20% VAT, regardless of whether they have crossed the sales threshold of £85,000.

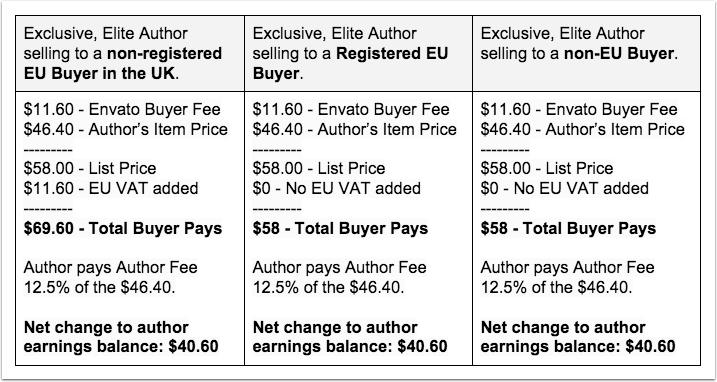

VAT for Envato Market – Envato Author Support

Navigate UK VAT for Global SaaS Companies

/wp-content/uploads/2023/06/dropshipp

VAT EU: What non-EU businesses need to know

VAT Number and VAT Registration

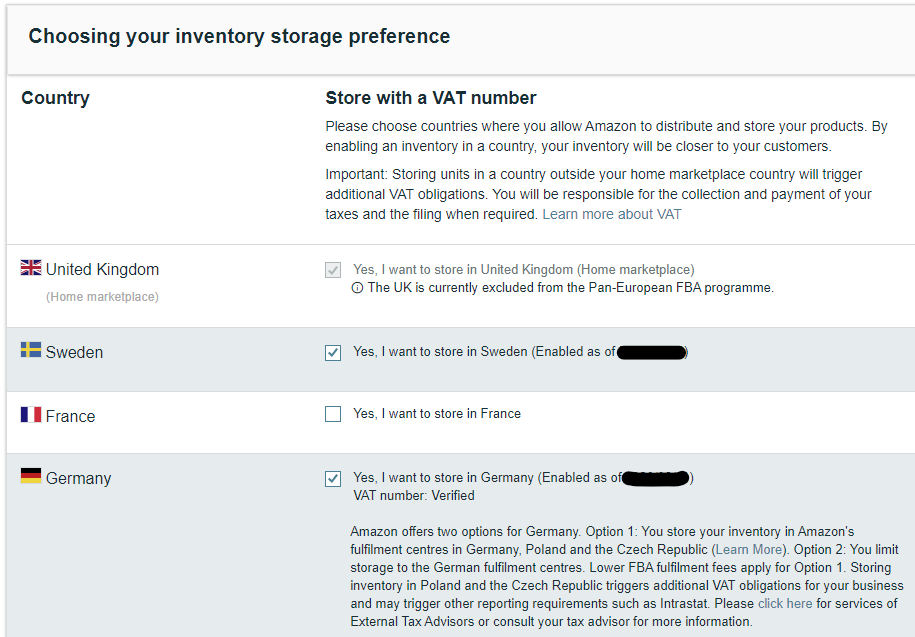

EU: e-Commerce VAT changes 2021 - Global VAT Compliance

EU 2021 One Stop Shop VAT return for e-commerce - Avalara

Amazing VAT mail I got from . I am very worried.

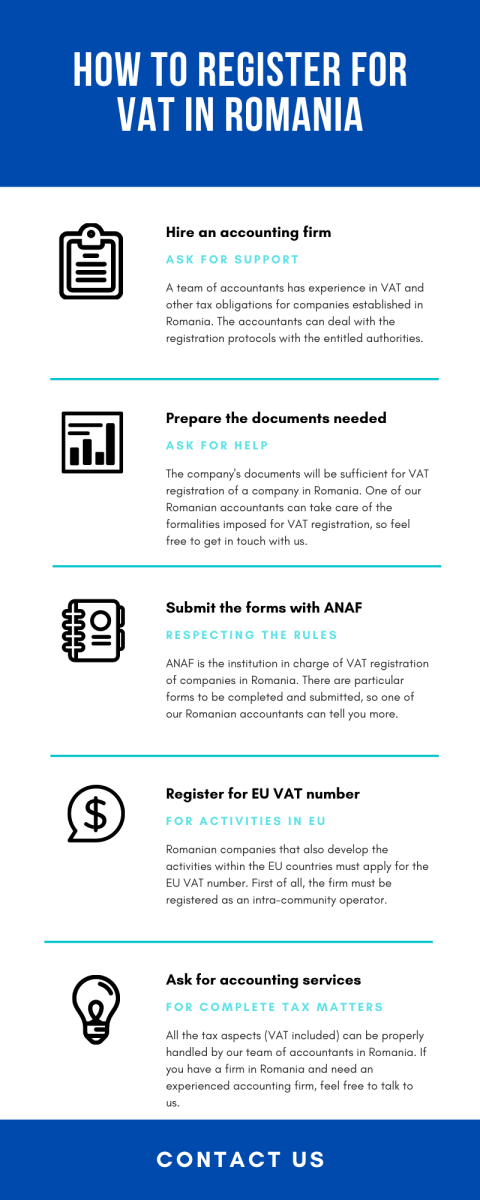

VAT Registration in Romania - Guide for 2022

Brexit Northern Ireland VAT and EORI numbers